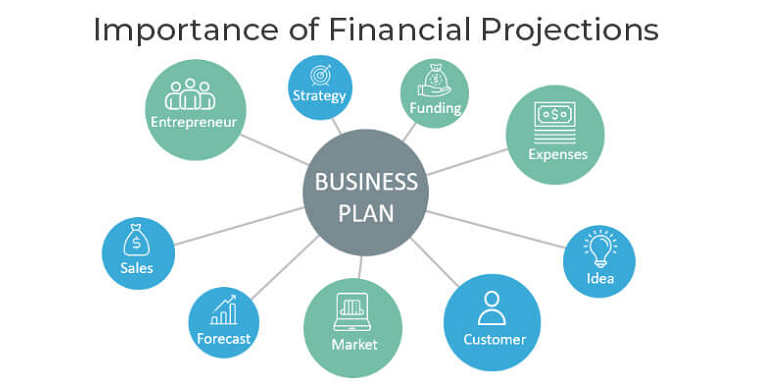

Accurate financial projections are not just numbers; they serve as a roadmap, a measure of success, and a tool for decision-making. They are also a mirror that reflects your understanding of your business, market dynamics, and growth potential – elements that potential investors closely scrutinize. Here we look into the importance of financial projections, their key components, and how to create realistic, well-grounded forecasts.

Contents

Understanding Financial Projections

Before getting into the nitty-gritty of creating financial projections, it’s essential to have a solid understanding of what they are and their role in business planning. A strong grasp of these concepts will form the foundation for your startup’s effective financial planning and management.

Basic Concepts Related to Financial Projections

Financial projections are estimates of a company’s future financial performance. They typically include forecasts of revenue, expenses, and net profit for a specific period, often three to five years. These estimates are influenced by various factors, such as market trends, competition, and your business’s operational efficiency.

Fundamentally, financial projections represent a numerical translation of your business plan. They demonstrate how your strategy and operations will result in financial outcomes, providing you with valuable insights into the potential profitability of your business model.

Role of Financial Projections in Business Planning

Financial projections are a vital part of any business plan. They help to communicate the financial goals of the startup, offering a roadmap that outlines how the business aims to grow financially over time. This roadmap can guide decision-making, helping you decide when and where to invest resources, or when to cut back.

Additionally, financial projections can help identify potential challenges or risks. By projecting your revenue and costs into the future, you might identify periods where cash flow could be tight or where expenses might outpace income. Such foresight allows you to plan accordingly and mitigate potential issues before they become critical [1].

The Impact of Accurate Financial Projections on Startup Success

The importance of accurate financial projections for a startup cannot be overstated. Not only do they help steer the direction of the business, but they also play a crucial role in securing funding. Investors and lenders expect to see well-prepared and realistic financial projections that show a clear path to profitability.

Moreover, by demonstrating that you’ve thoroughly researched and prepared for the financial realities of your startup, you show potential investors that you’re serious about your business. This credibility can make all the difference in a competitive funding environment.

Key Components of Financial Projections

Now that we’ve established what financial projections are and their importance to your business plan, let’s take a closer look at their key components. Understanding these elements will give you a more profound grasp of your startup’s financial landscape and equip you with the tools needed to create accurate and comprehensive financial forecasts.

Income Statement Projections

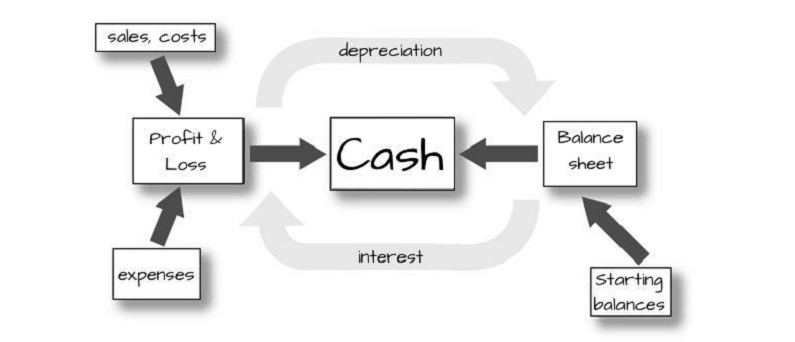

Your income statement, also known as a profit and loss statement, is a crucial component of your financial projections. It provides an overview of your revenues, costs, and expenses over a given period.

The aim is to estimate your net income by subtracting the total costs and expenses from the total revenue. This forecast allows you to visualize the profitability of your startup and can serve as a measure of the effectiveness of your business strategy.

Balance Sheet Projections

Next is your balance sheet, which provides a snapshot of your company’s financial position at a particular point in time. It includes your assets (what your company owns), liabilities (what your company owes), and equity (the difference between assets and liabilities, representing the owner’s share).

When projecting your balance sheet, consider both your current situation and your anticipated future activities. For instance, if you plan to acquire more assets or take on additional debt in the future, these should be included in your projections.

Cash Flow Statement Projections

The cash flow statement is another key element of your financial projections. It shows how cash moves in and out of your business, revealing how your operations, investing, and financing activities affect your cash position.

Understanding and projecting your cash flow is critical, particularly for startups, because it helps you anticipate periods of cash shortage or surplus. Regardless of your profitability, your startup can still fail if you run out of cash and are unable to meet your obligations [2].

Break-Even Analysis

Finally, the break-even analysis is an essential part of your financial projections. This analysis calculates the point at which your revenues exactly cover your costs, signifying the point at which your startup becomes profitable.

Knowing your break-even point can guide pricing strategies, sales targets, and cost management, among others. It also provides a tangible goal for your startup, serving as a key indicator of progress towards profitability.

Creating Realistic Financial Projections

Armed with a good understanding of the key components of financial projections, we can now delve into the process of creating them. This process requires a good deal of research, critical thinking, and some educated guessing. However, the payoff in terms of valuable insights and better decision-making makes it well worth the effort.

Conducting Market Research

The first step towards creating realistic financial projections is thorough market research. Understanding the market in which your startup will operate is crucial for accurate forecasting.

Investigate market size, growth rates, and trends. Identify your competitors, their market share, and how your product or service compares to theirs. Look for benchmarks in your industry and consider the economic climate and how it could influence your startup.

All these factors will play a role in shaping your financial projections, specifically your revenue forecasts. For example, market size and growth rates can provide a limit on the total revenue you might achieve.

Identifying and Evaluating Revenue Streams

Once you’ve gathered enough information about your market, the next step is to identify and evaluate potential revenue streams for your startup. A revenue stream represents how a company makes money from different customer segments.

Consider what products or services you’ll be selling, how much you’ll sell them for, and how many you expect to sell. Remember to be conservative in your estimates, especially in the early stages of your business.

When projecting revenue, it’s also important to take into account the sales cycle, which may delay the time it takes to realize revenue, especially for B2B (business-to-business) startups [3].

Estimating Expenses

Your next task is to estimate the expenses your startup will incur. There are two types of expenses you need to consider: fixed costs, which do not change with the level of goods or services produced (like rent and salaries), and variable costs, which do (like costs of goods sold).

When estimating your costs, consider all potential expenses, from marketing and advertising to office supplies. It’s often better to overestimate expenses and be pleasantly surprised than to underestimate and find yourself in a financial bind.

Assessing Future Capital Requirements

Lastly, you need to assess your future capital requirements. How much money will you need to keep your startup running until it becomes profitable? What are your plans for growth, and how will these be financed?

This assessment will guide your capital raising strategies and may impact your decisions around debt versus equity financing. It’s also an essential piece of information for potential investors.

Implementing Sensitivity Analysis

After your initial financial projections are in place, it’s essential to recognize that they are, at their core, informed estimates. To account for the inherent uncertainty and to test the resilience of your financial plan, it’s prudent to implement a sensitivity analysis. This process involves adjusting key variables in your projections to see how changes in these variables might impact your results.

Importance of Sensitivity Analysis in Financial Projections

Sensitivity analysis can play a significant role in strengthening your financial projections. It allows you to see how sensitive your profitability is to changes in different factors like sales volume, price, cost of goods sold, and overheads.

By exploring various scenarios, you can better understand the potential risks and opportunities your startup might face. For example, how will a 10% decrease in sales or a 5% increase in costs affect your bottom line? With this understanding, you can devise strategies to mitigate risks and leverage opportunities [4].

How to Perform Sensitivity Analysis

Performing a sensitivity analysis involves adjusting one or more variables in your financial projections while keeping others constant, then observing the impact on your results. Here are the general steps:

- Identify Key Variables: Determine the variables that can significantly impact your financial results. These might include sales volume, price, cost of goods sold, operating expenses, and others.

- Set a Range: Define a reasonable range for each variable. For instance, you might examine what happens if sales volume is 10%, 20%, or 30% lower or higher than your base case.

- Adjust Variables: One by one, adjust each variable through the set range and observe the impact on your net income, cash flow, and other important financial metrics.

- Document and Interpret Results: Record the results and interpret what they mean for your business. This insight can help you understand which variables you need to monitor closely and manage in your operations.

Pitfalls to Avoid When Creating Financial Projections

While creating financial projections is an integral part of planning your startup, it’s important to be mindful of potential pitfalls that could undermine their accuracy and usefulness. Here are some common mistakes to avoid and tips on how to navigate around them.

Overly Optimistic Revenue Forecasts

One common mistake is being overly optimistic in your revenue forecasts. While it’s important to be positive and ambitious, unrealistic revenue projections can lead to financial difficulties down the line. They can also discredit your business plan in the eyes of potential investors.

To avoid this pitfall, ensure your revenue forecasts are grounded in solid market research. Use conservative estimates, especially for the early stages of your business, and adjust your forecasts as real data comes in [5].

Underestimating Costs

Another common pitfall is underestimating costs. Startups often incur unexpected costs, and failing to account for these in your financial projections can lead to cash flow problems.

Consider all potential costs, both fixed and variable, and ensure you have a buffer for unforeseen expenses. Remember that it’s often better to overestimate your costs and have surplus funds than to underestimate and face a cash crunch.

Ignoring Cash Flow

Profitability is important, but cash flow is what keeps a business running. Ignoring cash flow in your financial projections can result in liquidity issues, even if your business is profitable on paper.

Make sure to include a cash flow statement in your financial projections. This statement should account for the timing of cash inflows and outflows, helping you plan for periods of potential cash shortage.

Neglecting to Update Financial Projections

Your financial projections should not be static; they should evolve with your business. Neglecting to update your financial projections as your startup grows and as new information becomes available can lead to inaccurate forecasts.

Regularly revisit and revise your financial projections. This habit will ensure that your projections remain relevant and provide valuable insights to guide your decision-making.

References

[1] How to Create a Financial Forecast for a Startup Business Plan

[2] Effective financial projections for a startup

[3] How to Make Financial Projections for a Startup

[4] 6 Things You Need to Research Before Creating Your Financial Projections

[5] Startup Cost and Financial Projections | SBEP Startup Class